Financial decisions carry risk, and so does the technology behind them. If you advise clients, lead a community bank, or oversee compliance, your cybersecurity posture now influences growth, client trust, and regulator confidence. The finance and insurance sector faces a concentrated threat mix where social engineering and system intrusion dominate. According to Verizon’s 2024 DBIR, the industry saw 3,348 incidents and 1,115 confirmed disclosures, with 78 percent of breaches tied to system intrusion, misc errors, or social engineering.

What follows is a practical checklist for financial leaders to tighten controls, reduce attack surface, and meet evolving obligations without slowing the front office.

Secure Client Communication

Sensitive instructions and portfolio details are prime targets for fraudsters who spoof domains and hijack threads. Pair encrypted email with secure file exchange and enforce message classification so staff know when data must travel in protected channels. Add advanced phishing filters and DNS authentication to reduce spoofing.

Image suggestion: Simple diagram of a secure communication flow that shows encrypted email, secure portal, and phishing filter checkpoints. Caption: How secure mail and portals protect sensitive client instructions.

Multi-Factor Authentication on Every Critical System

Password-only access is an open door. Require MFA across CRM, trading, banking dashboards, email, remote access, and administrator tools. Microsoft’s data shows that more than 99.9 percent of compromised accounts did not have MFA enabled. Turning on MFA blocks the vast majority of automated account attacks.

Tip list

- Apply phishing-resistant factors where possible, such as FIDO2 keys

- Block legacy protocols that bypass modern auth

- Monitor impossible travel and risky sign-ins

Remote Access and Endpoint Security

Hybrid work is standard. Standardize on an encrypted VPN or modern ZTNA approach, enforce device compliance before granting access, and harden endpoints with EDR plus SOC monitoring. Keep firmware, OS, and browsers patched on a set cadence. Monitor for privilege misuse and disable unused local admin rights.

Client experience note: CMIT Solutions can configure secure remote access, roll out EDR and SOC monitoring, and coordinate patching across your fleet while minimizing disruption.

Compliance That Keeps Pace with SEC, FINRA, and GLBA

Rules are shifting to faster disclosure and stronger customer data safeguards. In May 2024 the SEC updated Regulation S-P to require incident response programs that detect, respond, and recover from cyber theft of customer data, and to notify affected individuals in a timely manner for broker-dealers, investment companies, and registered investment advisers.

FINRA’s supervision continues to review governance, access controls, vendor management, incident response, and staff training. Its 2024 oversight report details focus areas firms should be ready to demonstrate.

Action items

- Map policies and technical controls to GLBA Safeguards and to your regulator’s expectations

- Maintain audit-ready logs, retention, and access histories

- Test breach notification workflows so legal and client communications are coordinated

Incident Response and Operational Resilience

A written plan is not enough. Test your playbooks, run tabletop exercises, and verify restore times from immutable backups. NIST’s Cybersecurity Framework 2.0 adds a Govern function to strengthen top-level accountability and risk decision making, alongside Identify, Protect, Detect, Respond, and Recover. Use this to frame roles, escalation, and oversight at the board and executive level.

Checklist

- Define severity levels and decision rights for executives and counsel

- Pre-draft regulator and client notification templates

- Practice full restore from backups, including time to business resumption

Third-Party and Vendor Risk

Evaluate custodians, core processors, trading platforms, and SaaS providers for MFA, logging, encryption at rest and in transit, and breach notification terms. Require penetration testing reports or certifications where appropriate. Track least-privilege access for external vendors and terminate it promptly after project close.

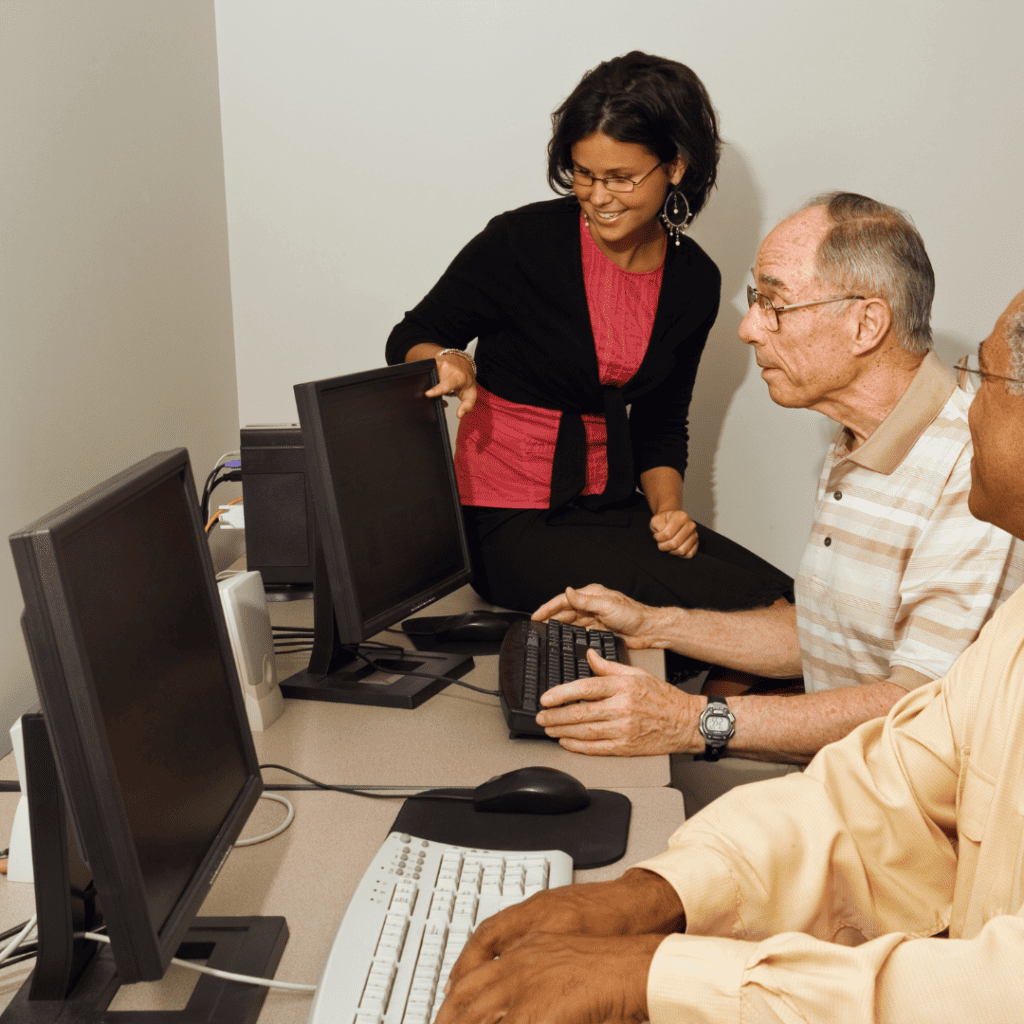

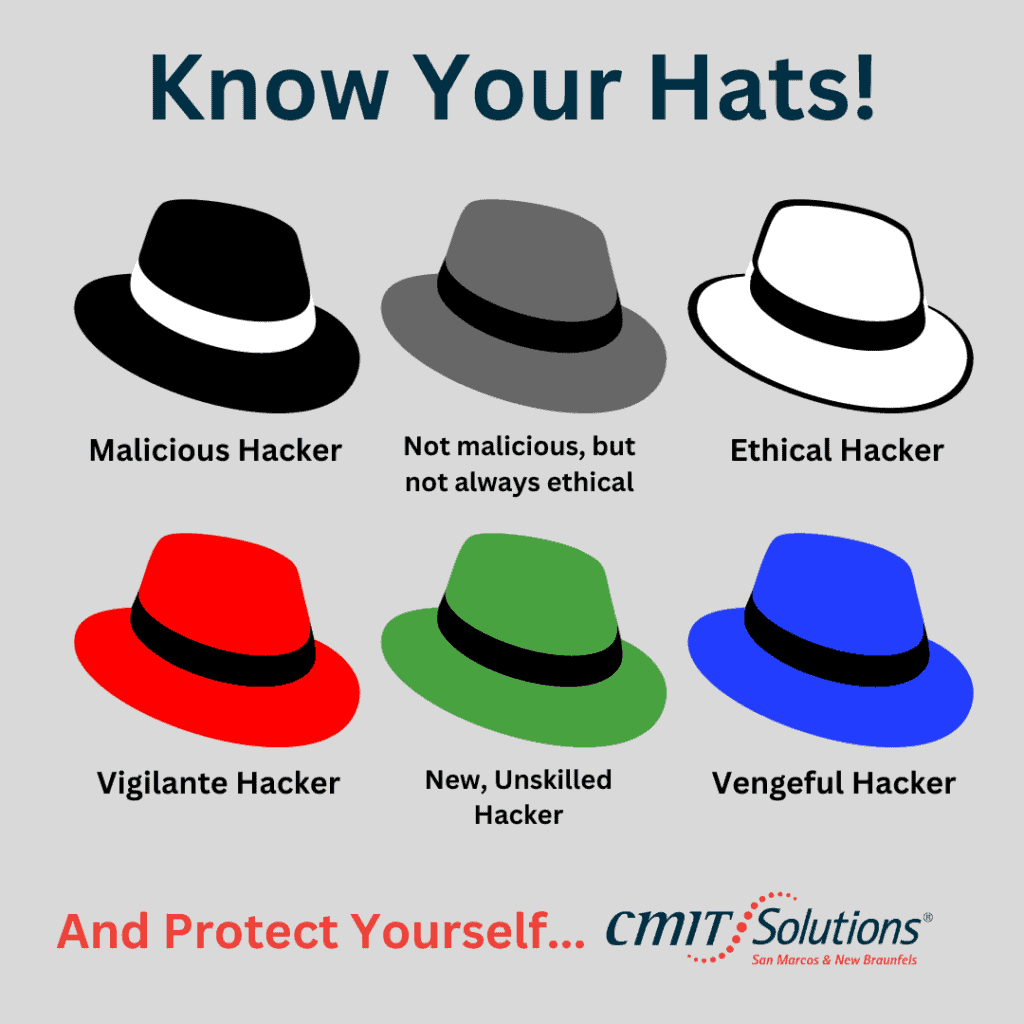

Security Awareness That Matches Modern Threats

Targeted phishing now uses convincing language and brand impersonation. Train staff on modern red flags, simulate phish regularly, and coach rather than punish. Expand training to wire fraud verification procedures for trade requests and account changes.

Why this all matters for leaders

Two realities are converging. Threat actors continue to favor credential theft and social engineering against finance. Regulators expect documented programs that prove detection, response, and recovery. Addressing the list above reduces the probability of an incident and reduces the blast radius if one occurs. It also reassures clients that you value their privacy and funds.

CMIT Solutions: Local accountability with enterprise-class defenses

CMIT Solutions of San Marcos and New Braunfels pairs 24 by 7 monitoring with a local, U.S.-based team. You get encryption, MFA rollout, EDR plus SOC, secure remote access, and audit-ready logging, along with IT support that does not slow the front office. That combination of neighborhood service and nationwide resources aligns with how financial firms prefer to work.

Next Steps

Financial services cybersecurity is now a leadership discipline. Start with secure communication and MFA, lock down remote access and endpoints, align controls with SEC and FINRA expectations, and pressure-test your incident response. If you want a partner to do this without added complexity, we are ready to help.

Schedule a free consultation with our team to assess current risk and build a prioritized roadmap.

Frequently Asked Questions About Financial Services Cybersecurity

Q: What cybersecurity rules affect public disclosures and customer notifications

A: The SEC updated Reg S-P in 2024 requiring incident response programs and notifications to affected individuals for certain registrants. Public company incident disclosures are also required for material events under the 2023 rules. Confirm specifics with counsel for your entity type.

Q: Which single control most reduces account takeover risk

A: Enforcing MFA across all critical systems. Microsoft reports that accounts with MFA avoid over 99.9 percent of automated compromise attempts.

Q: What changed in NIST CSF 2.0 that leaders should know

A: CSF 2.0 adds a Govern function so governance and risk decisions are owned at the top, and clarifies outcomes across Identify, Protect, Detect, Respond, and Recover. Use it to align policy, oversight, and metrics.

Q: What threats hit finance most often

A: In 2024, finance and insurance breaches were driven by system intrusion, misc errors, and social engineering, accounting for 78 percent of cases in the DBIR snapshot.

Q: How often should we test incident response

A: At least annually with tabletop and technical restore tests, and after any major system change. Include executives, counsel, and critical vendors so communication and recovery are coordinated.