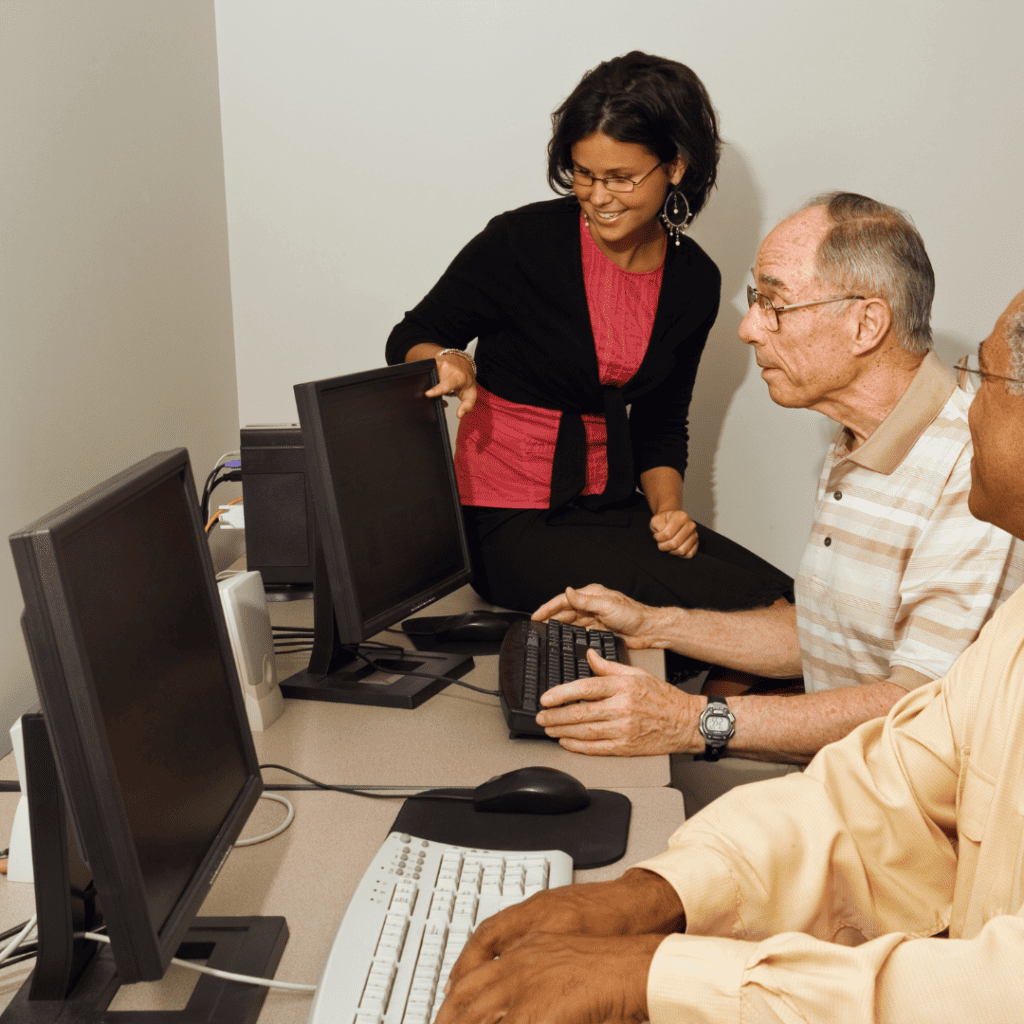

Cyber threats targeting law firms are rising sharply, making robust cybersecurity planning essential. Recent data from the American Bar Association (ABA) reveals nearly 1 in 3 law firms experienced a data breach in the past year, yet only 34% have an Incident Response Plan (IRP) in place. If your law firm in Central Texas hasn’t developed an IRP, now is the time.

An Incident Response Plan provides clear guidelines your firm follows during a cybersecurity incident, minimizing damage, reducing downtime, and protecting critical client confidentiality. Let’s explore the key reasons why your law firm urgently needs an IRP:

Protect Client Confidentiality

Law firms handle sensitive and privileged information daily. A breach can severely compromise attorney-client privilege and damage client trust. An IRP defines precise actions your team takes immediately following a breach, protecting critical data and preserving client confidentiality. With law firms increasingly targeted, having clear cybersecurity response procedures isn’t optional—it’s essential.

Ensure Regulatory Compliance

Law practices must adhere to strict regulatory frameworks, including ABA guidelines and Texas-specific data protection laws. A documented IRP demonstrates due diligence and preparedness, protecting your firm from regulatory fines or sanctions. The ABA underscores that ethical obligations include proactive cybersecurity measures, reinforcing the necessity of maintaining an updated IRP.

Minimize Downtime and Financial Loss

Cyberattacks can halt your firm’s operations and result in costly downtime. According to IBM’s latest cybersecurity report, firms with established IRPs recover faster, significantly reducing financial losses. A well-executed IRP ensures quick response and recovery, allowing your practice to maintain operational continuity and client confidence.

Clarify Roles and Responsibilities

Chaos during a cybersecurity incident worsens outcomes. An IRP clearly outlines roles for every team member, from investigating breaches and notifying affected clients to restoring critical systems. Clear responsibilities streamline the response process, minimizing confusion and panic, and ensuring rapid containment.

Improve Communication

During a breach, prompt and accurate communication is vital. An IRP includes pre-approved communication templates tailored to internal teams, clients, and regulatory bodies. Effective communication mitigates misunderstandings, manages reputation risk, and reinforces transparency and trust with your stakeholders.

Facilitate Cyber Insurance Compliance

Increasingly, cyber insurance providers require firms to have a documented IRP. Compliance with these prerequisites can directly influence your firm’s eligibility for coverage and lower insurance premiums. Being proactive with an IRP not only protects your data but can also lead to tangible financial benefits.

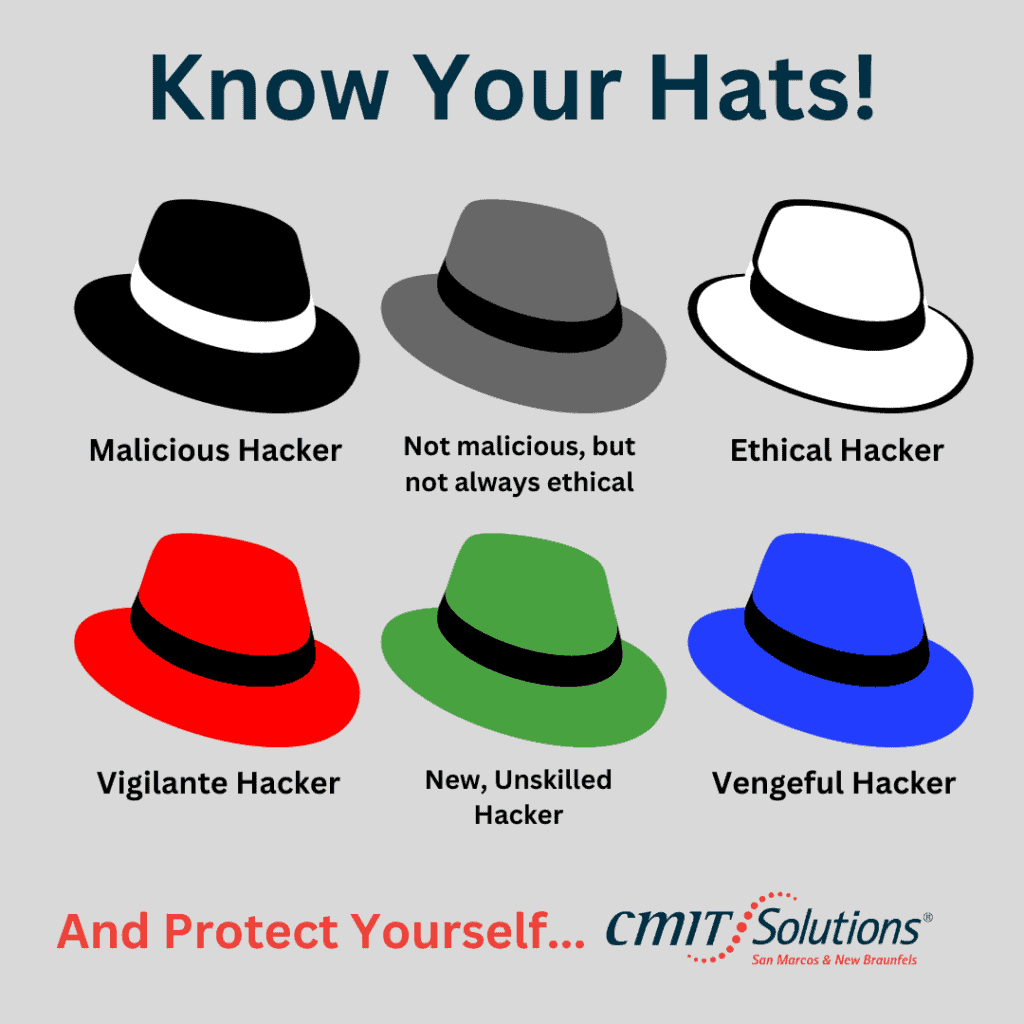

Enable Proactive Testing and Preparedness

An effective IRP includes practice drills and simulations. Regular tabletop exercises enhance your team’s readiness, ensuring that everyone understands their role thoroughly. Practicing these scenarios builds confidence and competence, allowing your firm to handle real incidents effectively and efficiently.

Final Thoughts

An Incident Response Plan is more than a simple document—it’s a cornerstone of your law firm’s cybersecurity strategy. With the increasing risks of cyber threats, having an IRP in place is vital. CMIT Solutions of Central Texas specializes in helping local law firms implement robust, effective IRPs tailored specifically to your needs.

Ready to secure your law firm’s future? Contact CMIT Solutions today—our Austin-based cybersecurity experts are here to help you establish a comprehensive Incident Response Plan.

Frequently Asked Questions about Incident Response Plan for Law Firms

Q: What should an Incident Response Plan for law firms include?

A: A law firm’s IRP should detail procedures for incident detection, roles and responsibilities, notification protocols, communication strategies, containment measures, and recovery processes.

Q: How often should my law firm update its Incident Response Plan?

A: It’s best practice to review and update your IRP annually or whenever significant changes occur in your IT infrastructure, legal regulations, or cybersecurity threats.

Q: Is an Incident Response Plan required by the ABA or Texas law?

A: While not explicitly mandated, ABA guidelines strongly recommend having a robust IRP as part of ethical cybersecurity practices, and compliance with Texas data protection laws increasingly requires formal incident management documentation.

Q: How does an Incident Response Plan differ from a Business Continuity Plan?

A: An IRP focuses specifically on responding to cybersecurity incidents, detailing immediate actions post-breach. A Business Continuity Plan outlines broader strategies to maintain business operations during various types of disruptions.