Practical protections for CPA firms, wealth managers, and lenders

In financial services, trust is currency. Clients hand you tax records, banking details, and Social Security numbers with the expectation that you will protect them. That trust is tested every day by phishing campaigns, account takeovers, and regulatory pressure. If you run a CPA firm, an RIA, or a lending operation, cybersecurity for financial services is no longer a cost center. It is how you safeguard revenue, reputation, and client confidence.

The stakes are real. Verizon’s 2024 Data Breach Investigations Report found that the human element played a role in 68 percent of breaches, with extortion techniques like ransomware present in nearly a third of cases. The FBI’s Internet Crime Complaint Center logged more than 21,000 Business Email Compromise complaints in 2023, with adjusted losses exceeding 2.9 billion dollars. Those numbers are not abstract. They show up as stolen refunds, diverted wire transfers, and after-hours panic during tax season.

Why Financial Firms Are Prime Targets

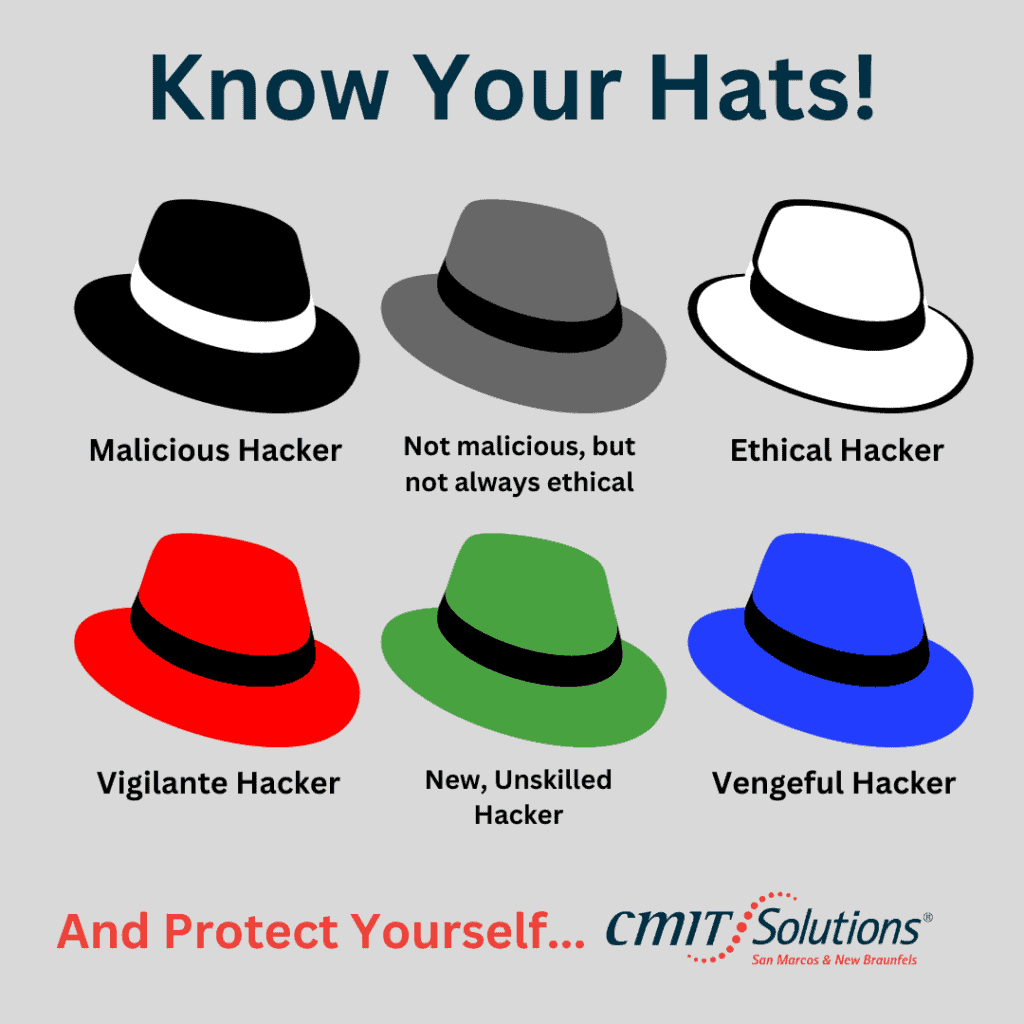

Financial firms aggregate high-value data and move money on tight deadlines, which makes social engineering unusually effective. Threat actors know that client wire instructions, tax transcripts, and KYC documents are worth more than passwords alone. They also know that small and mid-sized firms often rely on email as the primary workflow, which increases exposure to phishing, spoofing, and account takeover.

The Biggest Threats You Face In 2025

- Phishing and BEC. Spoofed vendor invoices and fake client messages create rushed approvals and silent mailbox rules that hide theft in plain sight. In 2023, BEC losses topped 2.9 billion dollars in the United States alone.

- Ransomware and extortion. Criminals increasingly steal data before encrypting systems, then threaten to leak sensitive financials to force payment. Extortion was associated with about 32 percent of breaches in the 2024 DBIR.

- Account takeover. Stolen credentials from cloud apps give attackers quiet access to client folders and bank portals.

- Third-party risk. A compromised payroll vendor or tax software plug-in can create a breach even when your internal controls are strong.

Compliance Is Not Optional

Regulators expect your program to match your risk. The FTC’s Safeguards Rule requires covered financial institutions to implement a written information security program, complete risk assessments, and maintain administrative, technical, and physical safeguards. The agency recently strengthened the rule with a breach reporting requirement for non-banking financial institutions. For broker-dealers and investment advisors, FINRA evaluates controls such as governance, access management, vendor oversight, incident response, and staff training, and frequently issues alerts about active phishing campaigns.

The Controls That Protect Client Data

Start with layered defenses that reduce human error and blunt the impact of a single click.

- Multifactor authentication everywhere. Require MFA for email, remote access, VPN, banking portals, and tax applications.

- Conditional access and least privilege. Limit sensitive systems to known devices and restrict admin rights.

- Email security that works. Combine advanced filtering, URL isolation, and DMARC alignment with secure mailboxes for payments and payroll.

- Endpoint detection and response with 24×7 monitoring. Modern EDR tools contain threats in minutes rather than hours.

- Patch and vulnerability management. Prioritize internet-facing systems and high-risk CVEs. Automate where possible to shrink the window of exposure.

- Encrypted, immutable backups. Use the 3-2-1 rule with off-site, tamper-resistant copies. Test restores quarterly so you know downtime targets are real.

- Device and remote work hygiene. Enforce full disk encryption, mobile device management, and secure remote access without exposing your internal network.

- Data classification and DLP. Mark PII and financial records, then prevent risky sharing by policy rather than by memory.

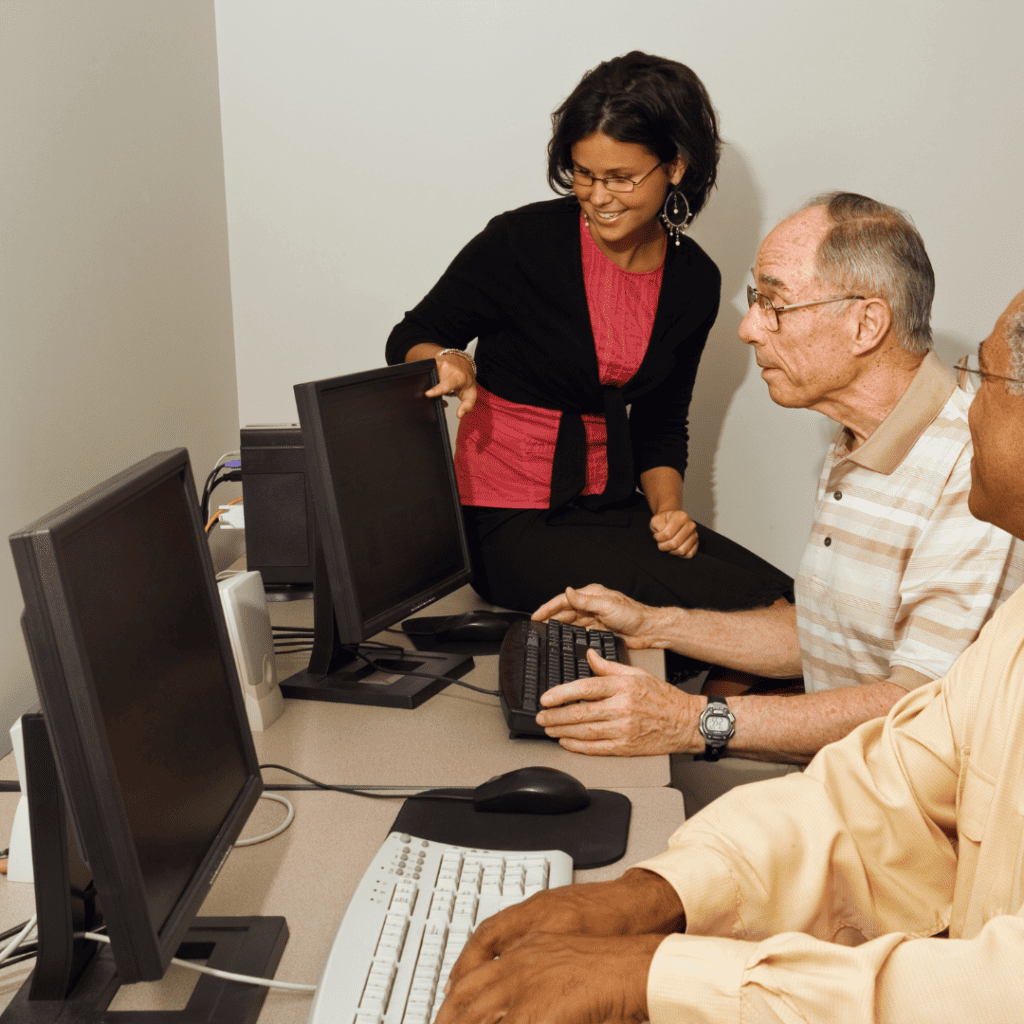

- Security awareness with simulations. Short, role-based training cuts click rates. The human element drives most breaches, so culture matters.

- Incident response playbooks. Define who does what, how to isolate systems, and when to notify regulators and clients.

What A Managed IT Partner Does for You

A strong partner turns best practices into daily reality. CMIT Solutions combines local, relationship-first support with enterprise-grade tools. Here is how that looks in practice.

- Assess. Map your data flows, vendors, and regulatory obligations. Baseline controls against frameworks and produces a prioritized roadmap.

- Harden. Deploy MFA, EDR, patching automation, and email security tuned to your workflows. Encrypt devices and implement conditional access.

- Monitor and respond. Watch endpoints, identities, and cloud applications around the clock so small anomalies are contained before they become incidents.

- Back up and recover. Maintain immutable backups and documented RTOs, then test them so the plan holds up during tax week.

Educate your team. Deliver short, high-impact training and realistic phishing tests that build muscle memory.

If you want deeper reading on a specific service as you evaluate partners, review CMIT’s Managed IT Services page and Cybersecurity Services page. Both outline the 24/7 monitoring and layered security you should expect from a provider.

Costs You Can Avoid

The average breach cost for financial organizations reached about 6.08 million dollars in the 2024 IBM study, which is significantly higher than the global average. Those costs include downtime, forensics, notifications, regulatory counsel, insurance friction, and lost trust.

Investing in controls, training, and recovery planning is not just an IT decision. It is a business decision that pays for itself the moment a phishing campaign hits your firm.

Final Thoughts

Trust is earned one secure process at a time. Build a program that meets your regulatory obligations, reduces human risk, and keeps client work moving during your busiest weeks. With the right partner, you can protect confidential data, pass audits with confidence, and give your team peace of mind.

Ready for a practical security assessment tailored to your firm? Contact CMIT Solutions for a complimentary consult and actionable roadmap. We will help you protect your clients, your data, and your reputation.

Frequently Asked Questions About Securing Trust in Finance

How does cybersecurity for financial services differ from general small business security?

Financial firms handle regulated data and high-value transactions, so controls must align to frameworks, include immutable backups, and cover vendor and payment workflows. Regulators also expect written programs, documented testing, and timely breach reporting.

What are the most common entry points for attackers in CPA firms?

Phishing, stolen credentials, and unpatched public-facing systems lead the list. Hardening email, enforcing MFA, and keeping systems patched shrink your risk quickly.

Do I really need phishing simulations if we already do annual training?

Yes. Short, regular simulations build habits and reveal risky workflows. They also show progress over time and help target coaching to specific teams.

Which backups qualify as ransomware-ready?

Use the 3-2-1 rule with at least one immutable, off-site copy. Test restores quarterly and document recovery time objectives, so leadership understands downtime risk.

What changes in the Safeguards Rule should I be aware of in 2025?

Covered non-banking financial institutions must maintain written security programs and, as of 2025, report certain breaches to the FTC. Work with counsel to scope reporting thresholds and timelines for your firm.