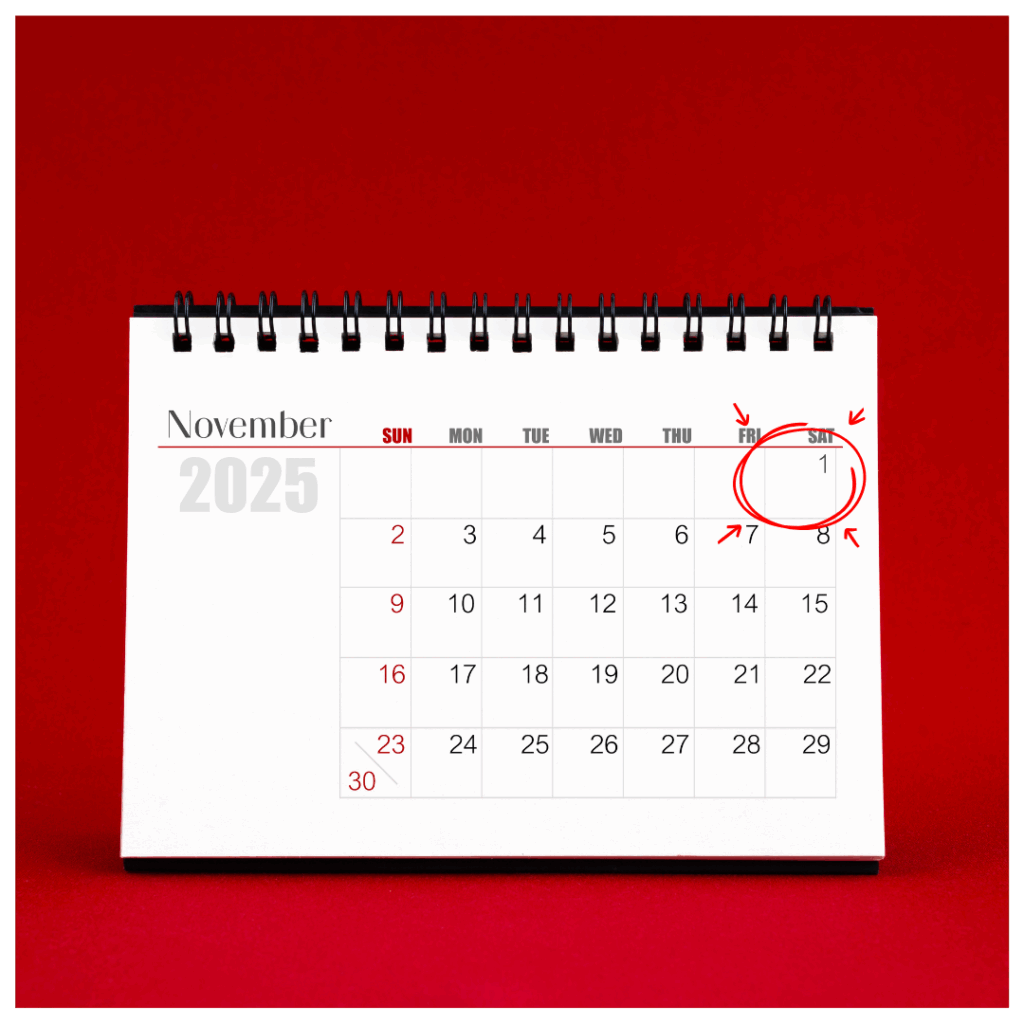

New York continues to lead the charge in financial services cybersecurity regulation, with the final phase of amendments to the state’s landmark cybersecurity rules approaching. As we move through 2025, organizations subject to the New York Department of Financial Services (NYDFS) regulations must prepare for the final set of enhanced requirements, which take effect on November 1, 2025.

The Regulatory Landscape

The New York Department of Financial Services released the finalized revisions to 23 NYCRR Part 500 on November 1, 2023 – the most significant modifications to Part 500 since it was first enacted in 2017. This second amendment represents the culmination of years of regulatory evolution, responding to an increasingly sophisticated threat landscape.

The amendments have been implemented in phases, with new requirements that started on May 1, 2025, including enhanced access management protocols, vulnerability management through automated scans, and improved monitoring measures. However, the most significant changes are still ahead.

[Related Reading: A Look at New York’s Data Security and Privacy Regulations for Small Businesses]

What’s Coming November 1, 2025

The final wave of requirements focuses on two critical areas that will fundamentally change how covered entities approach cybersecurity:

-

Mandatory Multi-Factor Authentication Expansion

All individuals accessing information systems must have multi-factor authentication implemented by the November deadline. This represents a significant expansion from current requirements and will affect organizations of all sizes within the NYDFS regulatory scope.

-

Comprehensive Asset Inventory Management

Perhaps the most operationally challenging requirement is the mandate for policies to implement and maintain an up-to-date asset inventory covering information systems. This goes beyond simple documentation – organizations must have robust processes to continuously track, monitor, and manage their entire technology infrastructure.

-

Enhanced Requirements for Larger Organizations

The amendments introduce a tiered approach, with more demanding requirements for larger entities, new obligations to report ransomware incidents and payments, and expanded oversight responsibilities for board and senior management. Class A companies – typically larger financial institutions – face additional hurdles, including implementing an automated vulnerability scanning system and enhanced monitoring capabilities.

-

Beyond Financial Services: Hospital Requirements

The regulatory expansion isn’t limited to financial services. New York State hospitals are now required to report cybersecurity incidents to NYSDOH within 72 hours, marking a significant expansion of cybersecurity oversight into the healthcare sector.

Preparing for Compliance

Organizations should focus on several key areas as the November deadline approaches:

- Infrastructure Assessment: Conduct comprehensive audits of current systems to identify gaps in multi-factor authentication coverage and asset tracking capabilities.

- Policy Development: Written policies and procedures must be designed to produce and maintain the required security controls, requiring organizations to formalize processes that may currently exist only informally.

- Technology Investment: The enhanced requirements often necessitate new technology solutions, particularly for automated vulnerability scanning and comprehensive asset management.

- Board and Leadership Engagement: Expanded oversight responsibilities for board and senior management mean cybersecurity can no longer be delegated entirely to IT departments.

[Related Reading: What Is The NY Shield Act]

The Broader Impact

These changes reflect New York’s position as a trendsetter in regulatory matters. As other states and federal agencies observe the implementation and effectiveness of these enhanced requirements, similar regulations may emerge across other jurisdictions.

The emphasis on asset inventory management and expanded multi-factor authentication aligns with federal cybersecurity guidance and industry best practices, suggesting that compliance with New York’s requirements will likely provide benefits beyond regulatory adherence.

Looking Ahead

With additional requirements taking effect through November 1, 2025, organizations should view this as the culmination of a multi-year regulatory evolution rather than an isolated compliance challenge. The comprehensive nature of these amendments suggests that New York has established what may become the new baseline for cybersecurity regulation in highly regulated industries.

As the November 1, 2025, deadline approaches, organizations should prioritize implementation planning to ensure they have adequate time to test and refine new systems and processes. The complexity of these requirements, particularly around asset management, suggests that waiting until the last minute could result in significant compliance challenges.

The final phase of New York’s cybersecurity amendments represents both a challenge and an opportunity – while compliance costs and operational changes are significant, organizations that successfully implement these enhanced controls will be better positioned to defend against the increasingly sophisticated threat landscape that prompted these regulatory changes in the first place.

Does all this leave your head buzzing? If you are not in the technology and/or cybersecurity business, that’s to be expected. Fortunately, the team at CMIT Solutions of Brooklyn lives and breathes in this realm! Connect with one of our experts today!