I’ve been in business long enough to see a truth that doesn’t make the MBA textbooks:

Brand damage often starts in the boardroom, not the breakroom. As unbelievable as it seems to onlookers, sometimes leaders burn their own brands.

The headlines that follow usually focus on the “what” — the scandal, the bad quarter, the stock plunge. But the real story starts months or years earlier, when senior leaders make decisions that ignore, misunderstand, or outright betray the value of the brand they’re supposed to be protecting.

Sometimes it’s arrogance. Sometimes it’s greed. Sometimes it’s just tone-deaf leadership. Whatever the cause, the results are often the same: brand equity built over decades — sometimes over a century — can vanish almost overnight.

Here are some of the most famous modern cases.

1. Volkswagen – Dieselgate

Brand promise before: German engineering at its finest. VW wasn’t just selling cars — it was selling precision, quality, and, increasingly, eco-friendly performance.

Leadership decision: In 2015, it came to light that senior executives approved software designed to cheat emissions tests, making diesel cars appear far cleaner than they actually were.

Brand damage: VW paid billions in fines, saw executives face criminal charges, and suffered a permanent trust deficit. The scandal shredded its “green” positioning and became a case study in how quickly a technical workaround can turn into a reputational sinkhole.

Lesson: Shortcuts that look like genius in the boardroom can become gravestones in the court of public opinion.

2. Wells Fargo – Fake Accounts Scandal

Brand promise before: For over 160 years, Wells Fargo was a symbol of dependability in American banking. Among the most respected brands in its category, it carried the kind of trust you can’t buy with advertising — you earn it through generations of service.

Leadership decision: In the mid-2010s, the bank’s senior leadership set aggressive sales goals that made “cross-selling” a religion. Under pressure, employees opened millions of unauthorized accounts to hit targets.

Brand damage: When the scheme was exposed, the public backlash was immediate. The CEO’s resignation, heavy regulatory penalties, and years of PR repair followed. Wells Fargo learned the hard way that a century of goodwill can vanish almost overnight when leaders fail to protect the brand’s core trust.

Lesson: Incentives that reward the wrong behavior will produce exactly that — and it can erase a century’s worth of brand equity in a single news cycle.

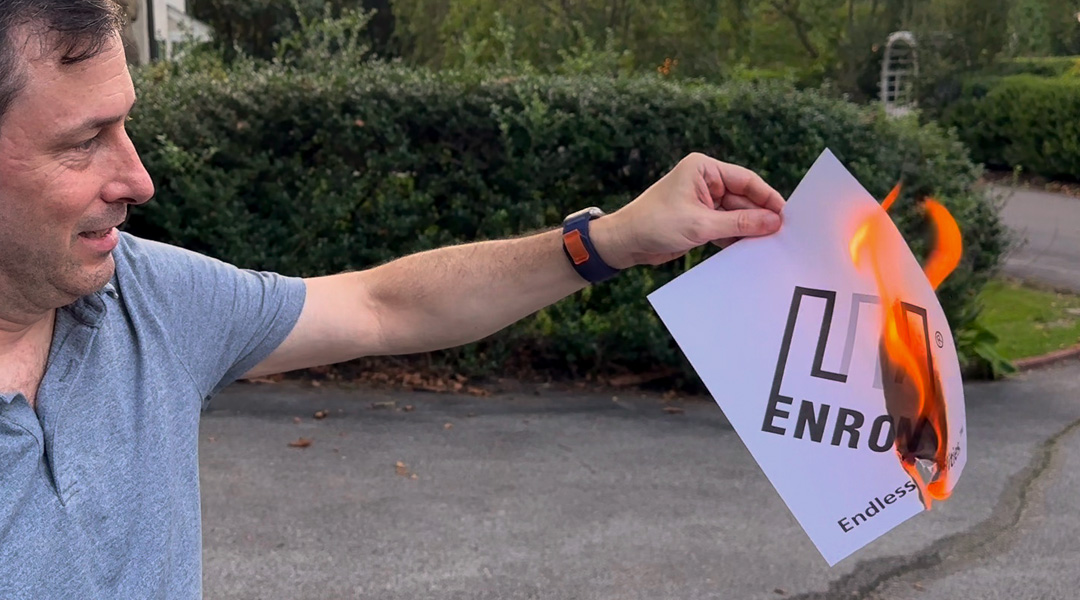

3. Enron – The Fall of a Corporate Star

Brand promise before: A bold, innovative energy company — the kind Wall Street loved to point to as the future.

Leadership decision: Senior leaders used complex accounting fraud to hide debt and inflate profits, misleading investors, employees, and the public.

Brand damage: The collapse wiped out thousands of jobs, destroyed employee pensions, and obliterated shareholder value. Today, “Enron” is shorthand for corporate fraud and hubris.

Lesson: Even the most skilled fabricators can’t spreadsheet their way out of the truth. Eventually, the math stops working.

4. BP – Deepwater Horizon Disaster

Brand promise before: BP had invested heavily in rebranding itself as “Beyond Petroleum,” positioning the oil giant as environmentally conscious.

Leadership decision: In 2010, the Deepwater Horizon oil rig exploded, causing one of the worst environmental disasters in history. While the operational failures were catastrophic, CEO Tony Hayward’s tone-deaf “I’d like my life back” comment became a PR disaster of its own.

Brand damage: Tens of billions in costs, a long-term stain on BP’s green credentials, and public anger that still resurfaces any time the brand talks sustainability.

Lesson: In a crisis, the words from the top matter just as much as the actions.

5. United Airlines – Passenger Removal Incident

Brand promise before: “Fly the friendly skies.”

Leadership decision: In April 2017, a paying passenger — Dr. David Dao — was forcefully removed from United Express Flight 3411 to make room for airline employees (“must-ride” passengers), after he refused to give up his seat because he needed to see patients the next day. Security officers dragged him off the plane, leaving him injured and unconscious — and footage of the incident went viral. Initially, United’s CEO defended the crew and called the passenger “belligerent,” sparking a further backlash before ultimately apologizing.

Brand damage: The incident became a social media avalanche. United’s response fueled anger and ridicule, and even prompted early-morning news segments, late-night comedy, and memes that remain etched in Internet culture.

Lesson: Defensiveness from leadership can turn a bad day into a permanent meme.

(It’s not the first time United found itself battered on social media for indefensible customer service positions. “United Breaks Guitars” has 28 million views on YouTube — a brand-storm the airline should have learned from eight years earlier, when it caused their stock to drop by 10%, costing United $180 million.)

6. Blockbuster – The Netflix Refusal

Brand promise before: The king of Friday night entertainment.

Leadership decision: In 2000, Netflix’s founders offered to sell their company to Blockbuster. The leadership declined and doubled down on brick-and-mortar rentals and late fees.

Brand damage: As streaming took over, Blockbuster became irrelevant almost overnight. Today, it survives only as a nostalgic reference with one lone store in Bend, Oregon. (Ironically, a movie about the sole surviving store, “The Last Blockbuster,” is available for streaming on Netflix.)

Lesson: Leaders who cling to the model they built often fail to see the model that will replace it.

7. JC Penney – Strategic Misstep

Brand promise before: Affordable prices and a constant stream of coupons and sales events that customers loved.

Leadership decision: In 2011, new CEO Ron Johnson tried to “elevate” the brand by eliminating coupons and sales in favor of everyday low pricing.

Brand damage: Loyal customers — price-conscious and conditioned to hunt for deals as part of the popular value-driven consumer culture — felt betrayed and left in droves. Sales fell 25% in a single year. Johnson was out in less than two years.

Lesson: If your brand is built on a core customer ritual, erasing that ritual is like cutting off the oxygen.

8. WeWork – Charisma Over Competence

Brand promise before: Revolutionizing office space for the modern workforce.

Leadership decision: Founder Adam Neumann pursued hypergrowth funded by massive venture capital, with lavish spending, questionable side deals, and eccentric governance — including chartering a $60 million private jet, selling the trademark rights to the word “We” to his own company for nearly $6 million, wild private-jet parties, declaring ambitions to become “president of the world,” and holding music-festival-style corporate retreats.

Brand damage: The IPO imploded, valuation collapsed, and Neumann’s personal brand became a liability. WeWork is still around, but as a far smaller shadow of its hype-fueled peak.

Lesson: A founder’s personal brand is inseparable from the company’s brand — for better or worse.

9. AOL + Time Warner – Merger Miscalculation

Brand promise before: AOL was the leader in online access; Time Warner was a titan in traditional media.

Leadership decision: The 2000 merger was hailed as a perfect marriage of “old” and “new” media. Instead, culture clashes and the dot-com crash destroyed the value.

Brand damage: AOL’s subscriber base began hemorrhaging almost immediately. By 2002, nearly 60% of web users planned to leave AOL for other services, and about 27% had already left in the prior year. Many migrated to Yahoo! Mail, Hotmail, and eventually Gmail — permanently taking their business to competitors. Over $200 billion in shareholder value evaporated, and AOL went from essential to irrelevant in just a few years.

Lesson: A merger built on hype without execution can hollow out both a brand’s value and its core customer base — especially when competitors are waiting in the wings.

10. Sears – From Main Street to Memory

Brand promise before: For more than a century, Sears was one of the most respected retail brands in America. It wasn’t just a store — it was a cultural institution, selling everything from houses to appliances to clothes.

Leadership decision: After hedge fund manager Eddie Lampert gained control in 2005, he ran Sears like a portfolio of competing divisions, pitting them against each other for resources instead of reinvesting in the stores and the customer experience.

Brand damage: The once-beloved Sears name became associated with empty shelves, tired stores, and broken promises. Store closures followed — and not just in big cities. Smaller towns and farming communities — many of which had relied on Sears as a one-stop resource in a pre-internet era — were suddenly cut off from a trusted and familiar retail anchor. The nearest alternative was often miles away, leaving residents stranded or forced to drive hours for supplies.

Lesson: When leadership forgets what made a brand beloved, financial engineering can’t save it.

11. Quaker Oats & Snapple – Losing the Magic

Brand promise before: Snapple was a fast-growing, quirky beverage brand with passionate fans. Part of its magic was personality — handwritten-style labels with oddball “Real Facts” under the cap, offbeat ads with the chatty “Snapple Lady,” and flavors with playful names like Mango Madness and Kiwi Strawberry. It didn’t feel corporate; it felt like an inside joke you were in on.

Leadership decision: Quaker Oats bought Snapple in 1994 for $1.7 billion, expecting another Gatorade-like success. Instead, they shifted marketing to appeal to a broader audience and changed distribution, moving away from the independent deli and corner-store network that had made Snapple a cult hit.

Brand damage: Loyal customers who loved the brand’s small-batch, offbeat vibe saw it lose its personality. Sales collapsed, and three years later, Quaker sold Snapple for just $300 million — a $1.4 billion loss.

Lesson: If you don’t understand what makes a brand resonate with its customers, ownership alone won’t keep them loyal.

The Recognizable Pattern

Looking across these examples, you see a pattern emerge:

• Misreading the brand’s core value.

Leaders either didn’t understand what customers loved or believed they could replace it with something “better.”

• Overconfidence in short-term wins.

A tweak that looks brilliant on paper can erode trust or alienate customers in reality.

• Failure to adapt — or adapting the wrong way.

Some clung to old models (Blockbuster, Sears); others chased a future their customers didn’t want (JC Penney).

• Greed and ego as accelerants.

From Enron’s accounting fraud to WeWork’s unchecked spending, leaders sometimes gamble brand equity to satisfy personal ambition or prove themselves right.

• Tone-deaf crisis handling.

BP, United, Wells Fargo — all made the situation worse with how they communicated in the aftermath.

These brands didn’t fail because they lacked history, money, or talent. They got burned because leadership decisions at the top severed the bond between the brand and the people who believed in it.

And that’s the final truth here: a brand can survive a bad quarter, a product flop, even a scandal — but it cannot survive leaders who misunderstand its soul.